Fitzwilliam Stone is a hard taskmaster, but it’s a fantastic place for women to succeed.”

Olive Ramchand, former Senior Partner Fitzwilliam, Stone, Furness-Smith & Morgan

In the Caribbean, women significantly outnumber men in the legal profession.

This is certainly not the case in the US or much of Western Europe where men still dominate. According to the UK’s Ministry of Justice website, women constitute approximately 39 per cent of barristers and 53 per cent of solicitors. Despite the upward trajectory, it was noted that women accounted for just 24 per cent of the partners at the top 100 law firms.

A cursory look at the websites of Trinidad and Tobago’s top law firms, shows partnership is no longer the preserve of men. This is demonstrably so at Fitzwilliam, Stone, Furness-Smith & Morgan where nine of the firm’s 12 partners are women.

What makes Fitzwilliam Stone a “fantastic place for women to succeed?”

The women at this firm come from diverse backgrounds, and have taken different routes to their legal careers. The five women interviewed for this article all attribute their success at Fitzwilliam Stone to hard work, a progressive environment, the commitment to high standards and a successful culture of mentorship. After meeting some of these women, it’s not hard to understand why they enjoy working at the firm and why they succeed in law and in life.

“Fitzwilliam Stone taught me to practice honourable law,” said Olive Ramchand who became the firm’s first female partner in 1992. “I was so happy to work with Gerald Furness-Smith, who was one of the most honourable men I’ve ever met.”

There wasn’t a formal mentorship progamme at Fitzwilliam Stone when Ramchand joined the firm, but she said the partners were all extremely supportive. In addition to Mr Furness-Smith, she acknowledged the role Sebastian Ventour and Danny Fitzwilliam played in her development.

Ramchand retired from the firm in 2020, but she’s still called upon for advice and consultation. “I’m glad that I was able to stay here for my entire career. Fitzwilliam Stone demands long, hard work, but any profession you want to excel in would do that. It doesn’t matter your gender, you just have to work hard.”

Hard work is one of Vishma Jaisingh’s core values. Growing up in Princes Town, her parents were her exemplars. Her father, a former Caroni worker also worked as a taxi driver to ensure his children had their school books, uniforms and everything they needed to get a proper education. Her mother, who she described as “an enterprising woman”, opened a parlour at their home to supplement the family’s income.

When Jaisingh joined the firm in 1999, Danny Fitzwilliam was her key mentor, she admired his “amazing” work ethic which she said mirrored her father’s. She described Fitzwilliam as “the most meticulous attorney” explaining that he took nothing for granted. As someone who came to law from a sociology and research background, this was hugely inspirational.

Jaisingh also counts the firm’s sensitivity and respect for personal values as one of the reasons she enjoys working there. A devoted Hindu, she is observant of all the faith’s religious practices and takes time off to participate in religious events.

“Everyone knows I’m not here on a Monday because I have certain religious commitments. I also appreciate when there’s an event at the office, they always check to see whether if I’m fasting and if I’m not, they ensure I have a vegetarian meal.

“My religion is a big part of my life and this firm has never discouraged that. I absolutely love working here.”

Fitzwilliam Stone is also a place that encourages its people to express their passions. On my first visit to the firm’s Sackville Street offices, I was struck by the pride of place given to work by some of the country’s leading artists.

I was told that much of the art was provided by Fitzwilliam Stone’s “unofficial art curator”, Senior Partner Tara Allum, a well-known supporter of the local art scene. Her love of beauty clearly serves to uplift the environment at the firm.

Allum who joined the firm in 1997, believes Fitzwilliam Stone provides an encouraging environment for young attorneys who are prepared to give. She also thinks the women who succeed show a certain amount of grit and self motivation.

“The women here are not shy or retiring. They tend to be able to hold their own but in a pleasant way,” she said. “They also show they’re up to the work by engaging more with the seniors and not simply waiting for someone to ask if they need help.”

Cynetta Lai Leung quickly recognised assertiveness and a strong ethic were essential when she first worked at Fitzwilliam Stone during her in-service training.

“What was clear to me was the high level that was expected of any lawyer working here. We had a reputation for doing excellent work – servicing clients with the best advice, meeting client needs – so early o’clock, I knew what how high the bar was.”

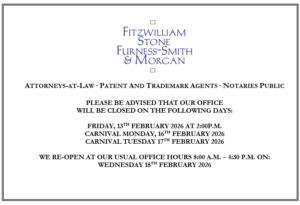

She recounted one of her best memories – and a case of exemplary client service – which happened one Carnival Monday morning when a foreign client needed urgent advice. Clearly, the fact that Port of Spain had been taken over by revellers and driving into the capital would be a nightmare didn’t matter to the client. So, Lai Leung had to join now retired partner Mark Ramkerrysingh at his home to work on the case.

“I was driving from my home in Diego Martin to Mark’s home because we couldn’t come to the firm,” she said. “So I’m driving over the hills in Maraval and when I got to the Paramin area and I was stopped by the boys playing blue devil and I said, ‘fellas let me just give you some money because I have to hurry to get to work!’”

Lai Leung is now the mother of an 11-year-old daughter and although she still works long hours, she is very intentional about how she shows up as a parent and the firm has given her the leeway to strike this balance. “My daughter is my WHY,” she said. “And what I do has to benefit her.”

After 20 years at the firm, Lai Leung is extremely happy to be playing a role in the Mentorship Programme which was officially implemented in 2010. Like her other senior colleagues, she acknowledged that it’s not only the associates who benefit.

Tara Allum said the firm has always had an “open door policy” and the Mentorship Programme was formalising a part of the culture that was always present. The senior attorneys ostensibly believe they’ve been stretched and in the process they’ve learned more about themselves.

“It can however, be a bit challenging if I have someone who’s interested in another area and I don’t feel as much to give in terms of expertise but I know I can give them support by checking in on how they’re coping with their workload and dealing with other issues.” Allum said.

“Being a mentor means opening up to someone and you can’t have a relationship with a mentee who thinks you’re intimidating,” said Vishma Jaisingh. “There was a notion that I could be intimidating so I did some introspection. I’ve developed an understanding with my current mentee and I share who I am with him.”

Jaisingh appreciates mentorship as a holistic process. “Mentorship for me is not just about the work, I think that’s secondary. Mentoring for me is about understanding what drives him, where he wants to get to and helping him along the journey.

Cynetta Lai Leung’s unexpected benefit from being a mentor is the way it helped her to uplift her capacity to lead. “As a partner, you’re now part of the leadership of the firm and to me, being involved in mentorship is a very crucial part of that. It’s an opportunity to shape the future partners in the way they’re going to think about their approach to work, the clients, and maintaining standards.

Ten years ago, she was extremely excited at the prospect of working with her first mentee, Stephanie Moe, a fellow Hilarian who she described as “pretty awesome”. Lai Leung’s pride was evident when she spoke about Moe’s blossoming over the last ten years.

In January 2024, Stephanie Moe became one of the firm’s newest partners and swears by the effectiveness and impact of the mentorship programme.

“It’s important to be surrounded by strong women who are ‘women minded’ and once you are willing to put in the work, they support and give constructive criticism when necessary,” Moe said.

Moe who exudes confidence and maturity beyond her 35 years, seems to have hit the jackpot with strong women who’ve been a part of shaping her life. From her mother Allison who is a source of constant support, to late cultural icon Pat Bishop who was an advisor during her during her performing years and late Senior Counsel Dana Seetahal who encouraged her early in her law career.

“It’s two-fold though, you don’t just have these women who are willing to nurture your career, you also have to be able to absorb the knowledge and the pearls of wisdom.”

She was a successful classical singer and a member of the Marionettes Chorale so working in an environment where there is a keen appreciation for art as well as her understanding of the creative sector were factors in the choice of her area of specialisation.

“It was really because I was open to different areas of law. Again, I go back to the mentorship programme because I really got a lot of support from the partners here. This firm has really cultivated who I am as an attorney”.

Franka Philip is a journalist and media consultant with local and international experience across the areas of print, online and radio.

Franka Philip

April 5, 2024